Being a startup, especially in an industry full of starry-eyed entrepreneurs, can be a stressful endeavour for the unprepared. There are so many beginner’s traps that it can be downright overwhelming for those who aren’t sure how to get started.

Thinking of Making a Will? Here Are Some Top Tips

All too often, the demands of everyday life offer a welcome distraction from the need for us to sit down and set about creating our wills. However, it needn’t be a chore – especially when you know how to avoid the pitfalls and ensure that you and your family are protected by a detailed and well-planned legal document.

Celebrating Christmas on a Budget

Spending money at Christmas is so easy to do, when we have the whole world of online shopping at our fingertips. It is so easy to simply click ‘buy’ and not to think about the money that you are actually spending. But, we can’t let that spending get away with us.

How to become the best trader in the Forex market

The top traders in the Mena region know a lot about the market. If you want to protect your capital, you should be following strategic steps to improve your skills at trading. People who are using a simple trading strategy over the period, are doing relatively well since they know the perfect way to manage the risk profile in a very strategic way. To protect your capital, you should be following standard rules and norms to improve your skills. It might seem very challenging, but it is the only way by which you can boost up the confidence level and take your skills to the next level. But to become a professional trader, you should be concern about your trade execution process.

Bad Credit Loans For Bail Bonds – Are They Worth it?

It is important to first understand what a bad credit loan is before examining whether they are worth the trouble. A bad credit loan is simply an option to relieve consumers with low credit scores of their borrowing limit. It is often a personal or consumer loan that can be used to bail a consumer out of a real financial emergency, including those with a credit score under 650. Most banks and financial institutions would not ordinarily lend consumers with a poor credit score. Quite often, people who are in need of getting a bail bonds will turn to these types of loans.

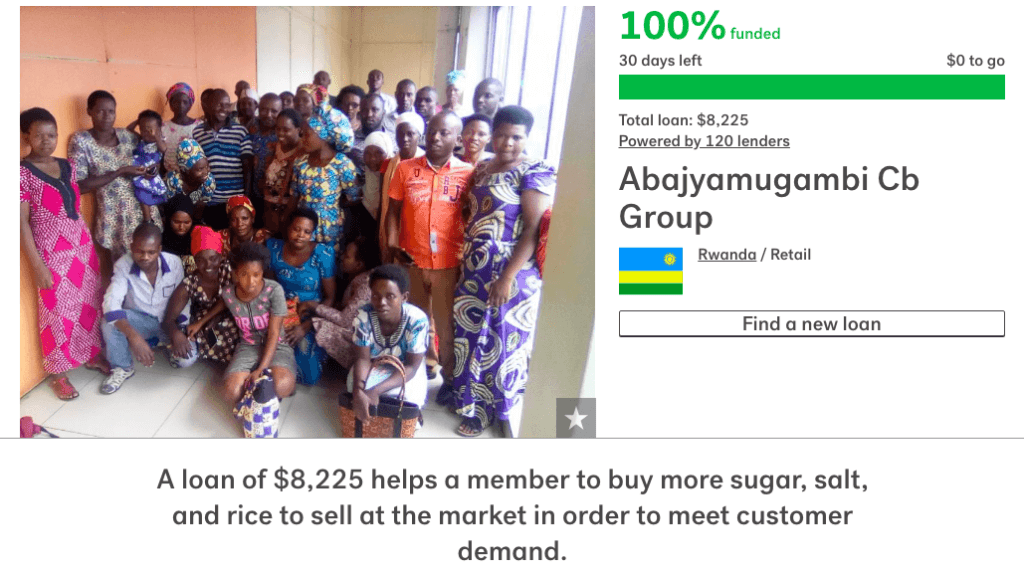

Kiva Magic: Exponential Power of Microlending

As friends and longtime readers know, I have been actively microlending through Kiva since getting my family inheritance, and deciding to experiment by “investing” $1000 in ten $100 loans to business owners and economic cooperatives around the world.

I reflected before about it when I made my 50th loan, and now I just made my 105th Kiva loan, and my original $1000 has been now been relent to reach $10,050.

What’s more is that because I’ve been sharing my microlending story, I’ve inspired 81 people to lend their own money. I truly hope to inspire YOU today, as Kiva is offering matching $1 Million in loans, just today (September 12, 2018). So, if you choose to start your own lending portfolio, you can make a $50 loan into $100, or a $100 in $200…over if you did the same $1000 investment that I began with lending, you’d double your impact on day one, and truly experience exponential growth.

Lastly, working with my kids to research the loan terms, we’ve tried to spread the wealth (which in this case feels like spreading the love). We’ve loaned to business people in 52 countries. I’ve prioritized mostly women-led loans and try to average the repayment length at about year, so I can relend regularly. They/we are still learning from the process, and it does make us feel more connected in the world.

Part of the reason why I decided to “invest” my money in this way is that I felt not just calling to philanthropy, but to fundamentally change the global economy. $10k may still be a drop in the ocean, but it’s one that helps me feel like I am making a difference and putting my money where my heart is.

Peace,

Darcy Rose

Leadership in the Financial Services Industry, with Dwayne Rettinger from Investors Group

Dwayne Rettinger is an Executive Financial Consultant and Certified Financial Planner professional (CFP) with Rettinger & Associates Private Wealth Management, which is a part of Investors Group Financial Services Inc., one of Canada’s largest financial service companies, based in Winnipeg. Dwayne and his Guelph, Ont.-based team at Rettinger & Associates specialize in a number of financial areas, including investments and retirement planning, group retirement planning, estate planning, cash management and tax planning. We sat down with Dwayne to discuss his leadership style and to answer some common questions he gets from clients. Continue reading

A Beginner’s Guide to the Everyday Transaction Account

A bank account helps you to keep your money safe and while still being able to easily access it when you need it, at any time. You may also open a bank account because you want to save and you need someone to help you limit access to your funds. Other times, you may simply open a bank account for receiving payments that require you to have a bank account. Continue reading

What can you learn from professional blogs?

Whenever you are searching for anything on the internet about Forex, there will be some pop-ups on your screen. Most likely it is the advertisements of the professionals’ blogs with a smile on it where it says you are one step away from changing your career. They are now giving discounts and you should not waste time and get their offers. It is their blogs and they write about their own ideas and things of the industry. This article will tell you if you can really learn something useful that you can use in your career by spending your time in reading these blogs. The number of these blogs is increasing and people are more thinking of them as a substitute for their strategy. Many people have also got this idea that if they read this blog then they do not have to use their strategy. They also do not have to analyze the market but only match the trend with their reading blogs. This idea is wrong and you need to know if these blogs are doing more harm than you can imagine.

The professional traders are always one step ahead of you. You have a lot to learn from senior traders in the United Kingdom. They know very well how to manage their losing trades. At times you might think that the expert traders have secret ingredients but in reality, they are just following the basic rules of investment.

If you start following reputed blog sites you can learn a lot. They publish articles on a regular basis which contains great Forex tips. But you should not blindly follow the tips of the expert traders. Use your intellect and see whether their analysis and tips in lines with your trading mentality.

What do they offer?

In order to know if these blogs are useful or not, you need to know what these blogs have to offer. Most of them offer some reading articles like how to trade, what the traders would do if they could go in their past and how they have changed their career. These are very simple articles but there is one thing that many people miss. They also write about the mistakes of their careers. If you are a novice trader, it is important for you to know the mistakes that all traders do in Forex market. You cannot know it until someone came to you and show your mistakes. These blogs help the traders to find their own mistakes and improve their trading. They also offer news and information about the ongoing market trend like which country has experienced a major deflation in the economy, which currency is getting stronger on the economic market and many other financial and currency-related information. They also tell you about the scams that had taken money from thousands of people. They are the live newspapers that are never getting old. Every day these blogs are publishing new articles and you will find some new information.

What can you learn from it?

The most important thing that you can learn from this blog is to avoid the mistakes that novice traders make. One of the mistakes is overtrading. Novice traders have a misconception that if they overtrade in Forex, they will have more chance of making a profit. This idea is wrong and reading the blogs can tell you what the reasons for losing money if you overtrade. You can also learn about developing your trading routine, how to analyze your mistakes and many other important findings. You can also learn about the bonuses that are offered in the industries by the brokers. You can also learn about the various professional courses they offer through their blogs. These courses are very helpful for all traders and you can improve your trading performance within a very short period of time.

5 Savvy Retirement Steps for Boomers

Baby Boomers, those born between 1946 and 1964, are retiring at a rapid rate, with an estimated 10,000 Baby Boomers retiring a day. Unfortunately, after decades of unsteady employment, many are retiring without enough retirement funds. If you belong to this generation, here are some tips to help you retire well:

Invest in final expense insurance.

If you’re unfamiliar with the significance of a final expense policy then you may be leaving your family without a way to cover your burial expenses. This whole life policy will help your family financially after you have passed away, helping to cover funeral expenses, which can range from $5,000 to $10,000.

Start saving and investing.

The sooner you start putting away money for your retirement years, the easier it will be to retire well, retaining the same quality of life that you enjoy now. If you start early enough, then you will benefit from the accumulation of compound interest gains. However, since savings grow at a slow and steady rate, you also need to learn how to invest some of the money you are setting aside.

If you don’t have enough money to invest, you will benefit from enrolling in your employer’s retirement plan and from getting a professional investment group to invest your money for you. Also, consider putting your money into mutual funds that require low initial investments. And you can always play it safe with Treasury securities.

Leverage your 401 (k) plan.

The best way to take full advantage of your employer’s 401 (k) plan is to meet your employer’s matching funds. Contribute enough to take advantage of this opportunity. If, for instance, your employer offers to match half of employee contributions, that is 50%, then be sure to contribute about 5% of your salary. So, if you earn $25,000 a year, then contribute $1,250. That way your employer will contribute $625. Understand that this is essentially free money.

The earlier you start, the more time you have to build up your savings because 401 (k) plans and IRAs have a cap on how much you can contribute. However, if you are age 50 or older, you are given a second chance to catch up on contributions and are allowed to go beyond the usual limits to catch-up.

Live within your means.

It can be difficult to live within your means for two reasons. First, you are dealing with a rising cost of living while your wages remain fairly stagnant. Second, you are surrounded by tempting offers all the time on things that would be nice to buy.

The way to have enough funds to begin saving for retirement is to work with a budget. Without one, it’s difficult to realize how much you’re spending. Simply keeping a mental tally is a highly inaccurate way of keeping track of your cash flow.

By setting a limit to how much you can spend on luxury items and by becoming more aware of where your money is going to maintain your current level of living, you will be acquiring an invaluable skill that will be highly useful when it comes to managing your money as a retiree.

Be aware of Medicare’s enrollment periods.

You will be eligible for Medicare around your 65th birthday and have a seven-month window to sign up. It’s important to sign up during this enrollment time because a permanent penalty may be added for late enrollment which will affect Medicare Part B as well as Part D premiums. Watch out – Medicare doesn’t cover everything, so if you have any extra money you might want to look into getting a supplemental medicare policy so you don’t get wiped out with catastrophic health care costs.

In closing, it’s important to mention that you should work with a certified financial planner if you feel overwhelmed by all the financial steps you need to retire comfortably. You are not alone. Professional help is available.