You’re probably too busy enjoying yourself, but you may have noticed that I don’t post on the weekend. There are a few reasons for this, most importantly that I need some down time to be re-inspired for the week ahead. This usually includes some type of “Frugal Family Fun,” like this past weekend spent with swim class, working in the garden together, and taking a family hike at the new Copper Mountain Nature Park

.

There’s also a practical reason, stats show that most people read blogs during work breaks on weekdays. For those of you who aren’t in that habit, you can catch up on a week’s worth of posts in your leisure time 😉

Not posting on the weekend also gives me time to do my “home work.” This weekend I’ve been testing the budget template that my Sis and I have been diligently perfecting for your budgeting pleasure.

While I can’t promise that it will take the work out of setting a budget and tracking your family spending, I do think that it will make the task quicker and more manageable.

Plus, part of my struggles with my old clunky outdated spreadsheet was that I felt like I was wasting my time altogether with innate calculation errors. Testing the template so far has me hopeful that it will solve some of my past frustrations.

On the weekends I’ve also been doing my home work by reading a few finance books, which I’d say is a commitment, since I’d rather be finishing up a truly entertaining book that I can’t seem to finish now that I’ve started this blog (The Geography of Bliss). But I have been learning about how to take steps toward financial abundance and that’s the whole point.

Get a Financial Life: Personal Finance in Your Twenties and Thirties

Financial Fitness for New Families

I’ll draw more on these resources in future posts, but now that my homework is wrapped up it’s time to get ready for a new week.

Do you assign yourself homework?

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.

Money Honey #3

-

Open joint account

-

Open EcoKids accounts

-

Each fill out a direct deposit form

-

Transfer money from two separate ING savings accounts (this will give us a surplus in our checking to cover expenses drawn from the new account until our direct deposit kicks in)

-

Switch automatic payroll savings transfer

-

Switch account info for each of our auto-pay accounts Hubby – mortgage, car loan, insurance, Netflix

-

-

Mama – child care, student loan, cell phones, natural gas, electricity, water/sewer, newspaper, Spud!, Costco American Express, Mastercard

-

Track when direct deposits and each auto-pay kicks in

-

Close each individual account once we are certain no more bills are linked to our old accounts

-

Shred old check books – purge old finance files

-

Celebrate!

Clean Energy Works – Part 3

We are elated to have accomplished our biggest household goal; fully insulating our leaky 1904 home. It was made possible through a new program in Portland called Clean Energy Works, which I’ve talked about in detail in Part 1 and Part 2.

EcoTech did a blow test before insulating, which measured that our old house leaked 5901 CFM (Cubic Feet Per Minute). After all the work was done, the house measured 3823 CFM, a difference of 2078 CFM! Increasing our home efficiency by a third feels like a good investment!

Only time will tell how much of a difference it will make for our utility bill and carbon footprint, but I will be to give seasonal updates and report out after the first year. Our efforts were further validated when I read how “energy efficiency is the best and cheapest way to cover the next generation’s electricity needs.”

Even though winter is past us (thank God!), we can already feel the difference in our home with the breezy spring. We’ve been talking with our BigGuy about the work being done and have explained that we’ve put a big blanket around our home. It truly feels cozy and snug, and it’s not just me feeling warm and mushy about the money saved and pollution curbed.

Beyond heating and cooling benefits, a benefit most people don’t think about is how much outside sound is reduced when your home is insulated. Our residential neighborhood is on the edge of the urban acitivity and we are totally used to hearing the “sounds of the city” (in quotations because we have a cute book with the same title 🙂 Yet, the general noise reduction has been calming.

What types of home efficiency has you invested in for your family?

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.

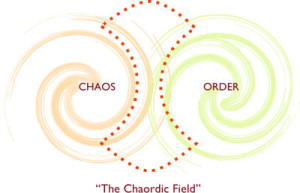

Chaordic Lives

Managing your finances on top of the responsibilities of a modern family can feel like uphill chaos.

No matter how organized and well-intentioned you may be, reaching long term financial goals requires a level of commitment that can sometimes feel out of reach in your busy daily life.

I know for myself that some days it’s hard enough to find my wallet, nonetheless update our budget. The good news is that’s perfectly O.K. as long as you keep your family moving toward your goals.

Managing your finances on top of the responsibilities of a modern family can feel like uphill chaos.

No matter how organized and well-intentioned you may be, reaching long term financial goals requires a level of commitment that can sometimes feel out of reach in your busy daily life.

I know for myself that some days it’s hard enough to find my wallet, nonetheless update our budget. The good news is that’s perfectly O.K. as long as you keep your family moving toward your goals.

At least that’s one of the lessons I got from a recent reading for a work-related leadership training about Dee Hock, past CEO of Visa International. Hock is an amazing thinker who structured Visa around the fundamental organizing principles of nature and evolution. Visa is perhaps the largest global company in terms of customers and transactions, and this success wouldn’t have been possible without tapping into Hock’s “chaordic theory.”

Here are a few of my favorite quotes from Hock:

Money motivates neither the best people, nor the best in people. It can move the body and influence the mind, but it cannot touch the heart or move the spirit; that is reserved for belief, principle, and morality.

The problem is never how to get new, innovative thoughts into your mind, but how to get old ones out.

Clean out a corner of your mind and creativity will instantly fill it.

Make another list of things done for you that you loved. Do them for others, always.

Carbon Calculator #2

I took my second crack at calculating our family’s carbon footprint by using one from Oregon DEQ. Even if you don’t live in Oregon, I would recommend trying it out. There’s nothing that would exclude non-Ducks/Beavers, although it does have a handy comparison between your footprint, Oregon average and U.S. average.

The most interesting thing was that it asked your family’s gross income. You can see instantly how your footprint either increases or decreases depending on your income level. The calculator assumes that your driving and consumption will increase by a third if your salary jumps from $50k to $100k. While I understand the assumption, I certainly don’t think it has to be that way.

I took my second crack at calculating our family’s carbon footprint by using one from Oregon DEQ. Even if you don’t live in Oregon, I would recommend trying it out. There’s nothing that would exclude non-Ducks/Beavers, although it does have a handy comparison between your footprint, Oregon average and U.S. average.

The most interesting thing was that it asked your family’s gross income. You can see instantly how your footprint either increases or decreases depending on your income level. The calculator assumes that your driving and consumption will increase by a third if your salary jumps from $50k to $100k. While I understand the assumption, I certainly don’t think it has to be that way.

Give the calculator a try and let me know how your family scores!

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.