“Drive Less. Save More.” is more than a bumper sticker on our family rig, it’s a motto that we try to live by daily. I’ll share some of steps we’ve taken to transport ourselves in a frugal and low-impact way.

1) Live close to where you live/work/play

This is truly the biggest factor in our ability to keep our costs and carbon impact low. When choosing your family’s home, make sure to account for the cost associated with transporting yourself for home to work and beyond. We can run 90% of our errands within 5 miles; I can walk in less than fifteen minutes to the bank, pharmacy, post office and grocery store, plus the community center and several family-friendly restaurants. Family’s often don’t take this into account, and end up paying at the pump, not to mention quality of life.

2) Calculate Your Costs

You’ve probably seen charts showing that the average American spends over $10,000 a year on transportation, driving an average of 12,000 miles. Metro’s “Drive Less. Save More.” campaign has a unique Driving Cost Calculator, which shows you what you spend currently, what you could save if you reduced your driving by 15% and 40%. This potential savings can be a good motivator to reduce your time behind the wheel.

3) Take Transit

Taking the bus or light-rail may not be an option for all families, but if it’s available near your home, don’t be intimidated to try it out. I’ll write more on this topic soon, since we take the bus every week day with two small ones. It can be fun and educational to take transit with your kids. If living in the suburbs is the only way to go for you, try carpooling. Most big areas offer programs or you can make connections at your workplace. Friends I’ve known who have carpooled enjoyed the camaraderie.

4) Mileage Matters

I wish I could say that our family car, a Subaru Forrester, gets great mileage, but it’s OK at best. Sadly, there are no good green family vehicles on the market yet. If you’ve got one you like, I’d like to hear about it! So, in the mean time, before a true eco-friendly family wagon exists, we’re going to have to continue to compensate by reducing our trips altogether.

5) Plan Trips Strategically

Often called “trip chaining,” planning your trips strategically can save you both time and money, which are both valuable to busy families. Make sure to plan your route to only include right hand turns, which the UPS found to be the quickest and thus most cost-effective. Simply taking a moment to plan out your trip will also help you feel more focused than frazzled, another genuine benefit.

6) Reduce your insurance costs

Insurance may be required, but there’s no need to overpay. You can quickly find

low cost car insurance rates that will get reduce your monthly transportation costs. There are also some companies that offer

pay-as-you-go plans, which gives incentives to driving less.

7) One Car

Owning only one car has always made sense to me. Perhaps it’s because I lived in Europe and biked everywhere before I ever got a driver’s license, but I promised myself long ago that my family would only have one car. Even when my Hubby worked in the burbs and I traveled to Seattle for grad school, we’ve always made our schedules work out. I know that those with older kids say that it gets harder, and I imagine it might.

But call us wacky, we like going places as a family. If you really think you need two cars, try a

ZipCar membership. Believe me, I looked into ditching our car altogether, but with car seats, camping and Doggy, it just wasn’t feasible.

8) Use Home Delivery Services

In many urban areas there are plenty of home delivery services, like grocery delivery and dry cleaning pick-up which can save you time and money.

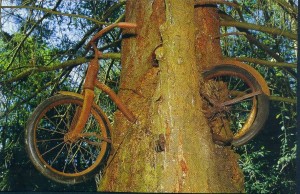

9) Bike Places

I once biked 12 miles a day and loved it, but I have to admit that biking has taken a back seat since I became a Mama. I do know plenty of Mamas who take their kids to school and then head to work by bike. I hope to get back in gear this spring…I’ll share more once I’m back on the saddle.

10) Think Twice

More than anything, reducing your family miles relies upon reframing your thought process around what it is possible and what you really need and want. In college friends would ask me how I could afford to travel back to Europe each summer, and the answer was simple: I didn’t have the expense of a car. If it motivates you, think about the payoffs or log the savings and put it towards a vacation fund.

Getting from here to there can seem to be the bane of modern existence sometimes, especially when we feel the twofold guilt of the cost and pollution.

But you can make a difference by finding ways to reduce your driving and save your family money. Which ways will you “Drive Less. Save More.”?

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.