I actually wrote this a full year ago (before we sold our Portland house, and bought our dream home in Astoria), but never posted it. I think I must have been too scared to believe, since it really didn’t feel possible at the time. Yet, before I share about manifesting our newest dream home, I thought I should finally post about our first experiences:

Our first dream home was a simple northwest-style cottage with cedar siding, hardwoods and plenty of lovely vintage windows. Before starting our search, we made up our wish list. The house matched it perfectly. It had just been flipped, so interior didn’t need much work, and we were able to focus our energy on designing and implementing my permaculture plan. We really wanted to be close to a park, and our place was so close to Arbor Lodge Park that I could watch dogs frolic as I washed the dishes. It was the perfect size for a couple, but as soon as I had Kieran, we suddenly felt cramped…for good reason; his nursery had previously been my closet.

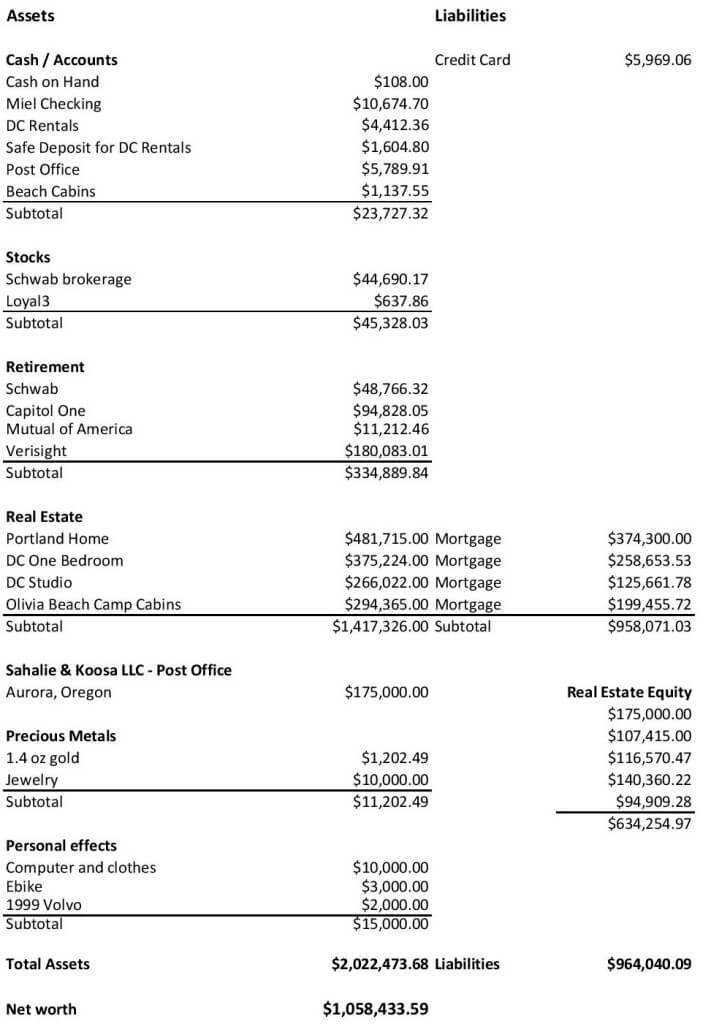

So, we started to house hunt. We looked at just one home that we fell in love with, which had almost an identical layout as our current home…our Realtor could hardly believe how similar the two homes were. But we quickly realized that we couldn’t afford what we wanted…de ja vu to my recent experience of feeling a big financial gap.

By another year later, we did both save and grow our income enough to afford the house we really wanted. It’s good to remember how I manifested it to begin with. I’ve told the story to plenty of friends about how when we were house shopping we had found a descent place in the Beaumont neighborhood near many friends, but the yard was tiny, the layout wasn’t great, and the kitchen was atrocious (think pink tiles with inset electric burners!). So, one night as I was debating whether I could manage a full kitchen remodel, I decided that I needed to envision what it would look like. In my mind I created an open floor plan with a butcher block island in the center, open white cabinets, stainless steel appliances, pantry space, and a cozy kitchen nook. Then I painted it purple and smiled as I drifted to sleep…

Then, just as we accepted a fantastic offer on our first home, I found the listing. Touring the house felt like a dream come true, as I checked off all the details on our wish list, including my perfect purple kitchen.

We’ve lived in our lovely 1904 Victorian for six years now, moving in when I was pregnant with Makenna. Kieran was a chubby faced toddler when we moved in. Our family has literally grown here with peaceful home birth memories for both of my daughters. It feels like home in the best of ways, and it is a sentimental place for me.

Lately our home no longer feels like my current dream home, even though I kind of nudge myself to be grateful for all the beauty and comfort that surrounds me. I’m simply ready to manifest a new dream home.

So, my first step is coming up a detailed list of my new dream home…then feeling the joy inside…then keeping the faith that we will be able to make the leap.

Do you live in your dream home? Do you believe in manifesting one?

Darcy