Long before there was email, people’s physical mailboxes were inundated with junk mail. Lots of it. Whole forests likely perished supplying the paper for mailings that tempted us with offers from Publisher’s Clearing House, cheap magazines, and the Columbia Record and Tape Club. Records and tapes, for you young people, were— oh, never mind.

Today, the process has been digitized of course and with the added efficiency provided by the Internet, that pile of junk has now become an electronic mountain. One advantage though, is that you can easily choose who sends you offers and what kind, with a few mouse clicks. But the competition is fierce.

Clever marketers have realized though, that the key to reaching their target demographic is through the path of least resistance— old fashioned snail mail. Between 2007 and 2012, according to the New York Times , the amount of physical junk mail dropped by 26 percent. That’s a bummer for the U.S. Postal Service, but welcome news for mailbox owners.

The average person gets far less physical junk mail today, so the odds of standing out are much greater. When you stop and think about it, physical junk mail has a lot of advantages over the electronic kind. Not only is there less competition, but email can be much more easily blocked. The space in which marketers have to operate is much smaller with email as well, at least in the introductory phase.

Physical mail can come in any variety of shaped and sizes, with space available to for all manner of words and images. Email’s first and only impression, is often a mere subject line, usually limited to around 50 characters. That’s it.

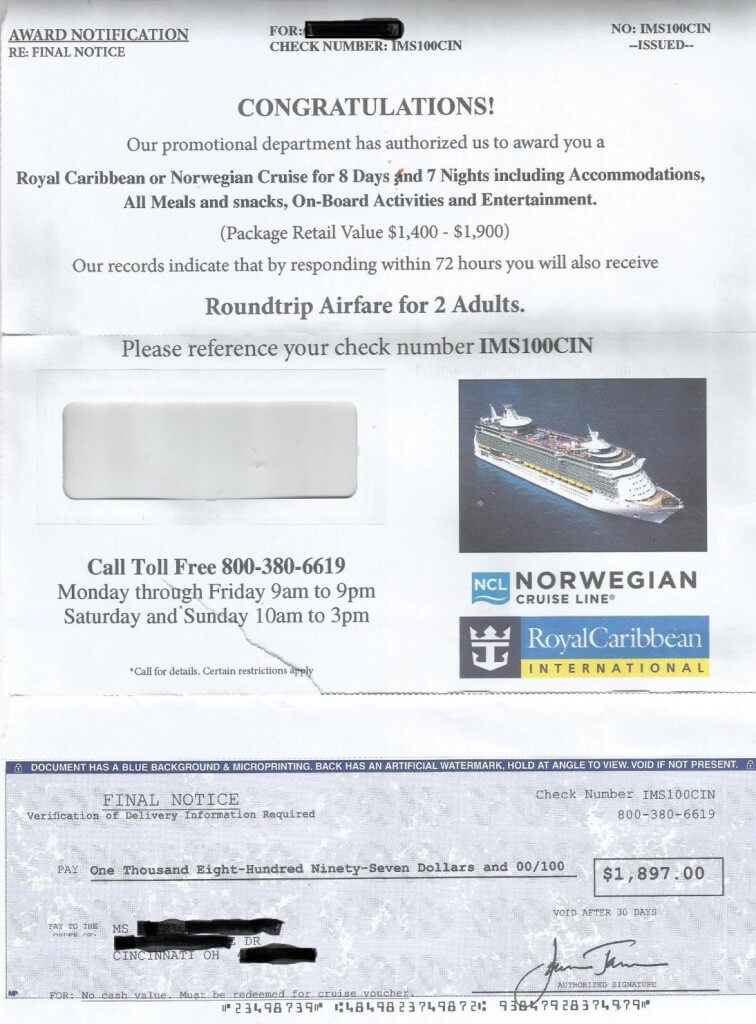

Marketers can make a physical piece of mail all kinds of enticing. For example, the one below that informs the recipients that they have won a free Caribbean Cruise. Call the toll free number to claim the prize. Sounds pretty easy, so why not?

Well, for one it arrived pre-sorted, or what is also known as bulk mail. That just feels sketchy. For most consumer advocates that’s the initial measuring stick. Does it look fishy (as it were for a cruise giveaway), or too good to be true? If so, discard immediately. But what if you call? Dollars and Sense decided to find out.

Thank you for calling

Again, the mailing we got a hold of stated that a Caribbean cruise on either Norwegian Cruise Lines, or Royal Caribbean International had been awarded. With round-trip airfare. Simply call to claim the prize. After waiting for several minutes, and being told repeatedly that our call was important, a representative finally came on the line. She asked for the claim number and put us back on hold for a few moments.

It turns out that the prize is being issued by a company called Endless Access (no kin to Axcess Financial, the company that owns Check ‘n Go). The representative says that Endless Access is a travel agency located in a nearby suburb called Blue Ash. However, a quick Google search returns no local office location for that company. They do have a website though.

The mailing is part of an advertising promotion, and to claim the prize you must only give 90 minutes of your time. During an hour and a half presentation they will present all the different travel services they offer. No obligation, just sit and listen. That doesn’t sound like a scam. Except it is. According to the Better Business Bureau, news reports, and some of the companies mentioned as partners in other mailings like Marriott Hotels, many consumers have complained endlessly about Endless Access.

According to a report by Alex Dunbar of CNY Central (a consortium of local TV stations in Syracuse, New York), seminar attendees are issued the vouchers. The problem is there are hundreds of dollars in fees associated with them, as well as loads of travel restrictions. It’s no wonder that they ask that you bring a credit card, and not a state-issued ID or driver’s license, as proof of your identity.

CNY Central also reports that membership with Endless Access is upwards of $9,000. And that doesn’t even involve any trips. You could go on a lot of Caribbean cruises for $9,000. People show up though. It’s almost like the Internet didn’t exist.

You can listen to the entire call to the prize claim line below or on our SoundCloud page.

Research and insights for this article were provided by Check ‘n Go.