I should have heeded my high school teacher’s advice long ago: K.I.S.S. – Keep It Simple Stupid. After ten years together, it’s time for Hubby and I to merge our money.

I should have heeded my high school teacher’s advice long ago: K.I.S.S. – Keep It Simple Stupid. After ten years together, it’s time for Hubby and I to merge our money.

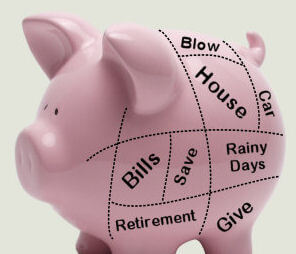

When you share kids, sharing finances doesn’t seem like such a big deal in comparison. It’s only actually been since our lives became overwhelmed by the hectic pace of family responsibilities that I’ve felt the urge to merge our finances. Since returning from maternity leave this fall, I’ve wanted to up my automatic payroll savings, but how much do I really have available to save? I’ve also been trying to sort out how many we can afford to tithe for our church, but I obviously don’t want to put us in financial jeopardy in the name of charity.

When I take the time to check my account online, I want to be able to quickly assess where our family stands financially. I feel like I’ve been in the dark lately not knowing whether we have the money there to spend or to save. (And, yes, I have tried using Mint, and initially was very excited in a nerdy kind of way about it, but unfortunately it doesn’t work with my community bank) I need to be able to answer these questions to have financial peace amongst the chaos of family life.

It’s also a trust and solidarity thing. I want to feel like my income is helping buy our home, not just pay for child care and the household expenses. I hope that merging our money will continue to build the foundation of trust that truly supports our family.

Lastly, yes, it will take a little juggling for Hubby to merge his auto-pay and auto-debits into my (our) account, but I promise to show my eternal gratitude and not nag him nearly as often.

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.