While perhaps not the loftiest of financial goals, everyone has to start where they are. I think virtually every finance guru out there would agree that tracking your family’s money is the only way to create a budget that reflects your true starting point.

While perhaps not the loftiest of financial goals, everyone has to start where they are. I think virtually every finance guru out there would agree that tracking your family’s money is the only way to create a budget that reflects your true starting point.

It used to be simple to track my budget, I remember in college I just had my checkbook, some crumpled receipts and a notepad. Oh, those were the days…

Adding family members complicates things, and I’ve been struggling since my Girly was born almost a year ago to keep tabs on what feels like the exponential growth of our family expenses. Unfortunately, our income has barely risen. (Although we are more grateful than ever for our career choices and sheer luck in this recession…we truly count our blessings!)

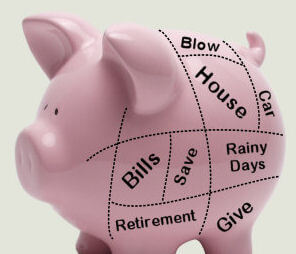

Yet, budget wise, it’s the things you “didn’t know you didn’t know” that make you blissfully (or painfully) oblivious. I want and need to know the true story of where my family’s finances stand. While it may intimidate me to calculate that I should be saving $500 per child each month to contribute to just 35% of a private college tuition, that doesn’t mean that I can afford to be paralyzed by fear either.

My first step was to borrow a budget template from my sister’s DINKs Finance blog. I have to admit that it was far superior than the template that I found earlier in the fall, and even though I had to scrap all the time I put into tweaking, I was ready to start fresh. I worked last Friday (on my Flex day off) to fine tune, and I’m optimistic that with a little elbow grease each month that I’ll be able to get the weight I’ve been carrying off my shoulders.

So, wish me luck, and I’ll keep you posted with my progress, insights, and lessons learned.

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.

Goal #1 – Get the true big picture

Leave a reply