If you divvied up your household spending into a single dollar, what would your pennies be spent on?

I’m guessing that the bulk would go toward housing and feeding your family, with transportation and child care requirements taking up another chunk of your “dollar.” Ideally you’d have enough money left to “play” with and that spending would reflect your unique values and interests. Yet, I’d be shocked to find any family I know spending significant portions on a security system or theft insurance.

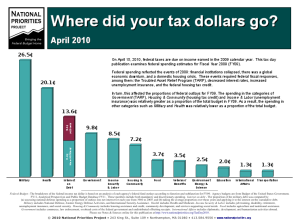

So, it still stuns me that the majority of federal taxes, our hard earned money, goes toward military spending. In 2009, U.S. taxes spent more on past military debt than education and energy/environment policies combined. Here’s a great graphic that shows where your money was spend, you can check out a full report from the National Priorities Project.

Think about it for a moment, where are our priorities as a nation? I respect service to your country, but is military indebtedness going to make our children safer?

~*~*~*~*~*~

Sustainable Family Finances

The story of a family creating an abundant and sustainable life.